Bitcoin Price Prediction 2025-2040: Analyzing Technicals and Market Sentiment

#BTC

- Technical Outlook: Short-term bearish below 20MA but MACD suggests accumulating momentum

- Market Sentiment: Whale activity and geopolitical factors creating volatility windows

- Long-Term Trajectory: Structural drivers like halving cycles and institutional adoption remain intact

BTC Price Prediction

BTC Technical Analysis: Short-Term Bearish, Long-Term Bullish Signals Emerge

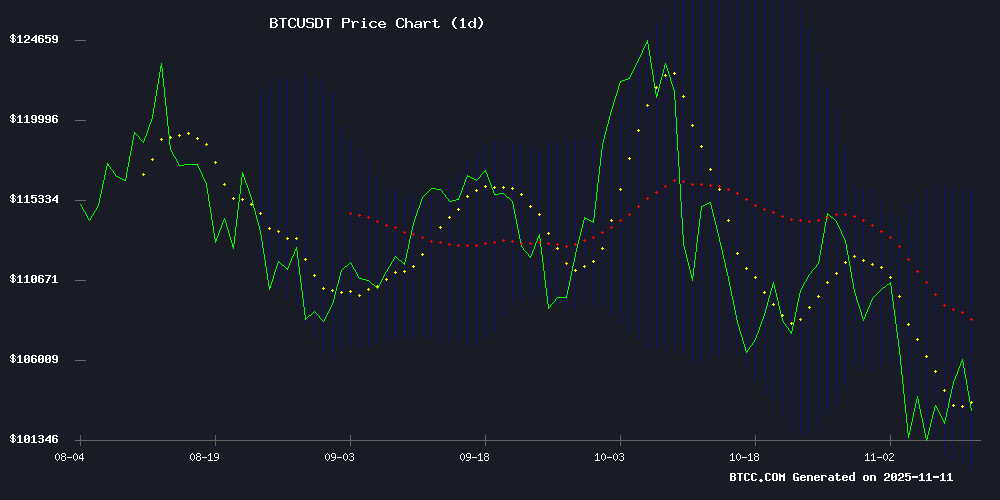

BTCC financial analyst Ava notes that Bitcoin (BTC) is currently trading at $103,211, below its 20-day moving average of $107,789, indicating short-term bearish pressure. However, the MACD shows bullish momentum with the histogram at +1,632, suggesting potential upward movement. Bollinger Bands reveal price hovering near the lower band ($99,484), which could act as support. Ava predicts a possible rebound toward the middle band ($107,789) if buying pressure increases.

Market Sentiment: Mixed Signals Amid Whale Activity and Macro Developments

BTCC analyst Ava highlights conflicting market signals: While 'historic liquidity patterns' suggest a rally to $120K, whale sell-offs and geopolitical tensions (China-US crypto dispute) create uncertainty. Positive developments like MicroStrategy's 487 BTC purchase and TeraWulf's 87% revenue growth counterbalance bearish news. Ava cautions that volatility may persist until BTC decisively breaks above $107,789 (20MA).

Factors Influencing BTC's Price

Historic Liquidity Pattern Resurfaces, Analysts Predict Bitcoin Rally to $120K

A rare liquidity signal that preceded every major Bitcoin bull run since 2020 has reappeared, with CryptoQuant's Ignacio Moreno noting stablecoin reserves have reached the same extreme levels that historically marked accumulation phases. The Stablecoin Supply Ratio—measuring Bitcoin's market cap against stablecoins—has dipped to 13, a threshold that previously coincided with BTC's strongest upward movements.

"When these liquidity conditions last appeared in 2020, 2021, and mid-2024, Bitcoin subsequently broke all-time highs," Moreno observed. Exchange reserve data now mirrors those pivotal moments, suggesting capital is poised to flow into BTC. Market technicians anticipate this configuration could propel the cryptocurrency toward $120,000 within months.

Bitcoin Whales Capitulate as New Entrants Lead Sell-Off Amid Market Volatility

Bitcoin's recent price volatility has triggered a wave of capitulation among newly formed whale addresses, with these large holders realizing significant losses as the cryptocurrency dipped below key psychological levels. Market analyst MorenoDV's examination of the bitcoin Realized Profits by Whales metric reveals one of the most aggressive sell-offs by new entrants this year, with over $1.3 billion in realized losses.

The sell-off suggests a dramatic shift in sentiment among recent institutional-grade investors. While Bitcoin has shown signs of renewed bullish strength following its drop below $100,000, the whale exodus underscores lingering uncertainty in the market. Such large-scale distribution typically occurs at market extremes—either signaling panic during downturns or profit-taking during rallies.

China Accuses U.S. of $13B Bitcoin Hack from LuBian Pool in Escalating Crypto Dispute

A geopolitical storm brews as China alleges American intelligence agencies orchestrated the 2020 theft of 127,000 BTC ($13.3B at current prices) from LuBian mining pool. The accusation follows a 2025 DOJ seizure of nearly identical Bitcoin holdings linked to Cambodian criminal group Huione.

Blockchain forensics initially pointed to a technical 'weak-key' vulnerability or insider job in the original hack. The U.S. maintains its seizure represents lawful confiscation of criminal assets, while China's CVERC counters with claims of state-sponsored cybertheft.

The incident marks a dangerous convergence of cryptocurrency markets, cybersecurity, and great-power tensions. Market analysts observe heightened volatility in BTC derivatives as the diplomatic row unfolds.

CleanSpark Announces $1.15B Convertible Note Offering to Fuel Bitcoin Mining and AI Expansion

Nasdaq-listed Bitcoin mining firm CleanSpark is making a bold $1.15 billion bet on the convergence of cryptocurrency and artificial intelligence. The company's senior convertible note offering, set to close November 13, will fund expansion of mining operations and AI infrastructure development.

Nearly 40% of proceeds ($460 million) will be allocated to stock buybacks at $15.03 per share, while remaining funds target data center growth, power infrastructure, and debt repayment. This strategic move mirrors the industry's accelerating pivot toward high-performance computing applications beyond traditional crypto mining.

Bitcoin Whales Accelerate Sell-Off, Pressuring Market Below $100K

Bitcoin's largest holders have liquidated billions in holdings since December's peak, undercutting bullish attempts to reclaim $110,000. The cryptocurrency now trades below $100,000 for the first time in five months—a threshold CryptoQuant CEO Ki Young Ju identifies as the bull market's inflection point.

Institutional inflows from MicroStrategy and spot ETFs temporarily delayed bearish momentum, Ju noted. But Santiment data confirms whale sell-offs now directly drive downward price action. When major investors exit, support levels dissolve like sandcastles against a tide.

October saw long-term holders dump 400,000 BTC ($45 billion), creating what 10x Research calls an 'unbalanced' market. Yet Ju suggests contrarian opportunities exist: 'If you believe in the macro outlook, this is when you accumulate.' The question becomes whether ETF inflows can counterbalance the whale exodus.

Silver Tipped as Next Breakout Asset Amid Bitcoin's Soaring Valuation

Robert Kiyosaki, author of 'Rich Dad Poor Dad,' has identified silver as the next high-potential asset for investors priced out of Bitcoin's $105K threshold. Drawing parallels to his early Bitcoin purchase at $6K, Kiyosaki projects silver could surge to $70—and eventually $200—calling it a parabolic opportunity for wealth creation.

The analysis underscores a growing narrative of alternative asset opportunities as flagship cryptocurrencies like Bitcoin become less accessible to retail investors. Silver's affordability and industrial utility position it as a strategic hedge, with Kiyosaki framing it as a democratized entry point akin to Bitcoin's early days.

Bitcoin Price Dump Finally Over? Analyst Explains Why It Is Time To Invest

Bitcoin's recent crash on October 10 triggered the worst liquidation event in crypto history, sending prices plummeting below $100,000 for the first time in four months. Yet, as the market stabilizes, analysts are debating whether the downturn presents a buying opportunity.

Crypto analyst MarcPMarkets argues that BTC's current price NEAR $100,000 offers a favorable entry point. Despite bearish sentiment, Bitcoin's capped supply and the inflationary macro environment position it as a hedge against fiat devaluation. "The endless money printing by governments only amplifies Bitcoin's value," MarcPMarkets notes.

The cryptocurrency's potential for a bullish reversal is underscored by its historical resilience. With institutional interest growing and macroeconomic conditions favoring scarce assets, Bitcoin may be poised for recovery.

Lightning Network Faces Identity Crisis as Bitcoin Community Debates Its Legitimacy

A heated debate over the Lightning Network's role in the Bitcoin ecosystem has erupted following a viral online survey. More than 80% of respondents rejected LN as "not real Bitcoin," highlighting growing skepticism about its technical limitations and long-term viability.

Key figures like Alex Gladstein and Matt Corallo defended the LAYER 2 solution, while critics such as Paul Sztorc of LayerTwo Labs pointed to persistent challenges. "After six years, it's clear the system doesn't function as planned," Sztorc argued, citing dependency on liquidity providers and constant node connectivity requirements.

The controversy underscores a fundamental divide in Bitcoin's scaling philosophy, with LN proponents advocating for off-chain efficiency and purists insisting on-chain transactions represent the only true Bitcoin.

US Senate Ends Government Shutdown; Cryptocurrency Market Awaits Reaction

The US Senate passed a bill to end the longest government shutdown in history, a move that had previously rattled investors and market participants. Cryptocurrencies, which initially dipped during the shutdown, showed tentative recovery signs after President TRUMP hinted at a resolution. Bitcoin briefly reclaimed $106,000 before settling at $105,000 amid ongoing market uncertainty.

Investor confidence may see a boost post-shutdown, but the crypto market remains bearish. Monday's minor rally was partly attributed to Trump's announcement of a $2000 tariff dividend for most Americans. Despite October's historically bullish trends, the crypto sector has struggled to gain momentum over the past month.

TeraWulf Q3 Revenue Jumps 87% on Bitcoin Surge and AI Diversification

TeraWulf's third-quarter revenue soared to $50.6 million, marking an 87% year-over-year increase. The Bitcoin miner capitalized on BTC's price rally and early-stage AI infrastructure deals, offsetting a decline in production volume.

While the company mined only 377 Bitcoin—down from 555 in Q3 2023—the average selling price of $114,390 per BTC drove digital asset revenue to $43.4 million. The remaining $7.2 million came from high-performance computing leases, including partnerships with Fluidstack and Google.

The earnings rebound follows Bitcoin's halving event in April 2024, which compressed industry margins. TeraWulf's pivot toward AI hosting services now complements its Core mining operations, with multi-year contracts already secured.

MicroStrategy Adds 487 BTC to Its Treasury in Latest Purchase

MicroStrategy, led by Chairman Michael Saylor, has expanded its Bitcoin holdings with the acquisition of 487 BTC. The purchase, executed at an average price of $102,557, cost the company $49.9 million. This latest addition brings MicroStrategy's total Bitcoin treasury to 641,692 BTC.

Funding for the acquisition came from sales of the company's STRF, STRK, STRD, and STRC at-the-market stock offerings, as disclosed in a filing with the SEC. The buy occurred between November 3rd and 9th, diverging from MicroStrategy's typical pattern of purchasing near weekly Bitcoin price highs.

Analyst Maartunn noted the unusual timing, pointing out that the latest purchase coincided with a local bottom in Bitcoin's price rather than a peak. This deviation suggests the newly acquired tokens may avoid the immediate underwater status of some previous purchases.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and market conditions, BTCC's Ava provides these projections:

| Year | Conservative Target | Bull Case | Key Drivers |

|---|---|---|---|

| 2025 | $110K-$125K | $150K | ETF inflows, halving effects |

| 2030 | $250K-$300K | $500K | Institutional adoption, scarcity |

| 2035 | $600K-$800K | $1M+ | Global reserve asset status |

| 2040 | $1.2M-$1.5M | $2M+ | Network effect maturity |

Note: These estimates assume no black swan events and continued adoption growth.